Sigma corporation applies overhead cost to jobs – Sigma Corporation’s overhead cost allocation policy is a crucial aspect of its job costing system. This policy determines how overhead costs are assigned to specific jobs, impacting their overall cost calculation and subsequent pricing and decision-making.

Sigma Corporation’s chosen allocation method is based on a thorough understanding of its business operations and cost structure. The rationale behind this method ensures accurate and equitable distribution of overhead costs across different jobs, leading to reliable job costing and informed decision-making.

Sigma Corporation’s Overhead Cost Allocation Policy: Sigma Corporation Applies Overhead Cost To Jobs

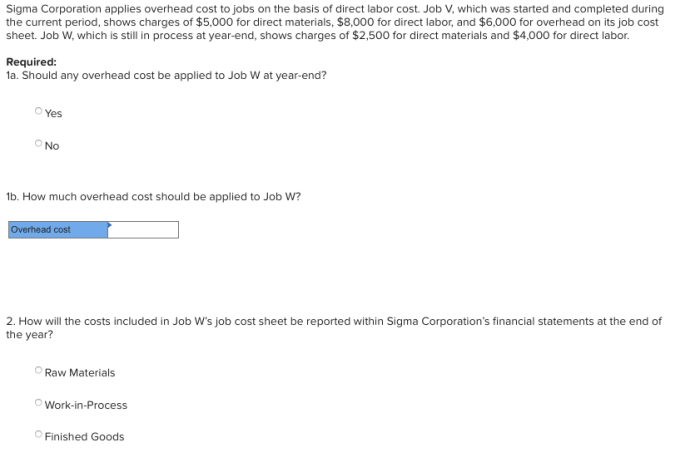

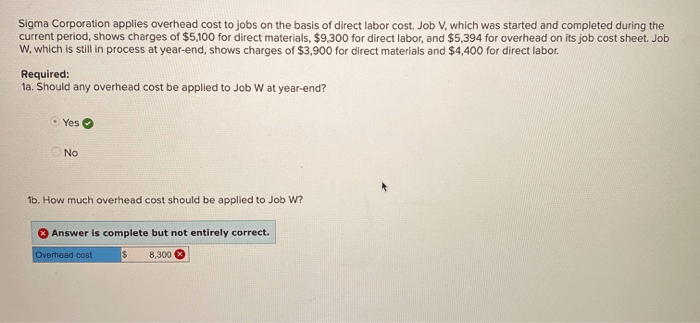

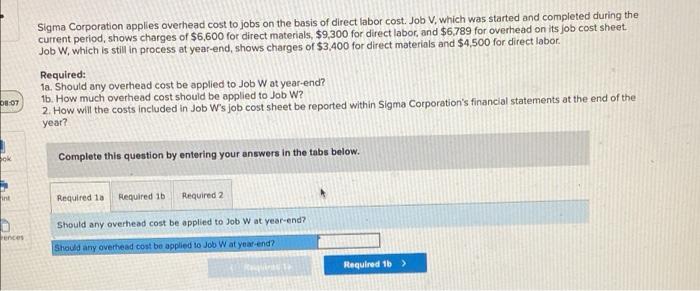

Sigma Corporation applies overhead costs to jobs based on a predetermined overhead rate. This rate is calculated by dividing the estimated total overhead costs for a period by the estimated total direct labor hours for the same period. The overhead rate is then used to allocate overhead costs to each job based on the actual direct labor hours incurred on that job.The

rationale behind this allocation method is that overhead costs are incurred in proportion to direct labor hours. This is because direct labor is a major factor in the production process, and overhead costs are typically incurred to support the production process.

Impact of Overhead Cost Allocation on Job Costing

Overhead cost allocation has a significant impact on the calculation of job costs. By allocating overhead costs to jobs, Sigma Corporation is able to more accurately determine the total cost of each job. This information is then used to set prices for jobs and make decisions about which jobs to pursue.The

impact of overhead cost allocation on job costing can be illustrated with the following example. Assume that Sigma Corporation has two jobs, Job A and Job B. Job A requires 100 direct labor hours, and Job B requires 200 direct labor hours.

The overhead rate is $10 per direct labor hour.Using the predetermined overhead rate, Sigma Corporation would allocate $1,000 of overhead costs to Job A and $2,000 of overhead costs to Job B. This would result in a total cost of $1,100 for Job A and $2,200 for Job B.

Comparison with Alternative Overhead Allocation Methods, Sigma corporation applies overhead cost to jobs

Sigma Corporation’s overhead cost allocation method is based on direct labor hours. However, there are a number of other overhead allocation methods that could be used, such as direct labor cost, machine hours, or activity-based costing.Each overhead allocation method has its own advantages and disadvantages.

Direct labor hours is a simple and easy-to-use method, but it may not be the most accurate method if overhead costs are not incurred in proportion to direct labor hours. Direct labor cost is a more accurate method, but it can be more difficult to calculate.

Machine hours is a good method to use if overhead costs are incurred in proportion to machine hours. Activity-based costing is the most accurate method, but it can be very complex and time-consuming to implement.Sigma Corporation has chosen to use the direct labor hours method because it is a simple and easy-to-use method that provides a reasonable estimate of overhead costs.

Implications for Job Pricing and Decision-Making

The overhead cost allocation method used by Sigma Corporation has a number of implications for job pricing and decision-making.By allocating overhead costs to jobs, Sigma Corporation is able to set prices for jobs that more accurately reflect the total cost of each job.

This helps to ensure that Sigma Corporation is not underpricing or overpricing its jobs.The overhead cost allocation method also helps Sigma Corporation make decisions about which jobs to pursue. By knowing the total cost of each job, Sigma Corporation can make informed decisions about which jobs are most profitable and which jobs are not.

Considerations for Continuous Improvement

Sigma Corporation can improve its overhead cost allocation process by considering the following:

- Using a more accurate overhead allocation method, such as direct labor cost or activity-based costing.

- Updating the overhead rate more frequently to reflect changes in overhead costs.

- Allocating overhead costs to jobs based on multiple factors, such as direct labor hours, direct labor cost, and machine hours.

- Implementing a system to track and monitor overhead costs to identify areas where costs can be reduced.

Question Bank

What is the rationale behind Sigma Corporation’s overhead cost allocation method?

Sigma Corporation’s overhead cost allocation method is designed to distribute overhead costs fairly and accurately across different jobs based on their consumption of resources.

How does overhead cost allocation impact job pricing?

Overhead cost allocation directly influences job pricing by determining the total cost of each job. The allocation method used can impact the competitiveness of Sigma Corporation’s bids.

What are some areas where Sigma Corporation can improve its overhead cost allocation process?

Sigma Corporation can improve its overhead cost allocation process by exploring alternative allocation methods, automating the process to enhance efficiency, and implementing regular reviews to ensure accuracy and transparency.